Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

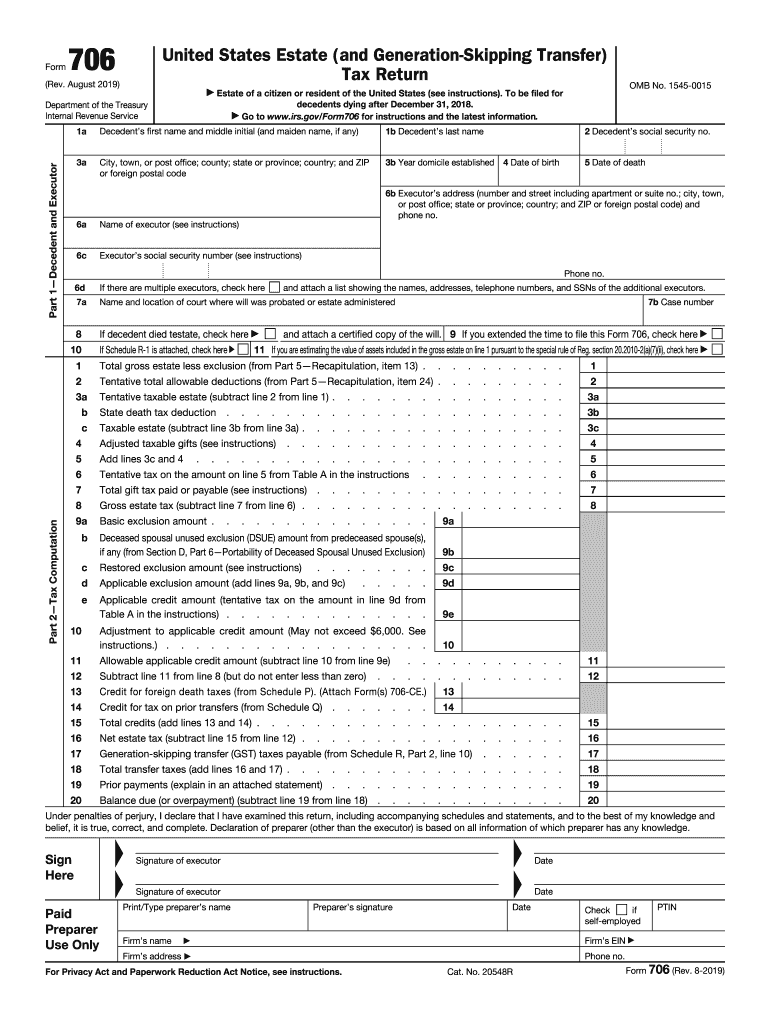

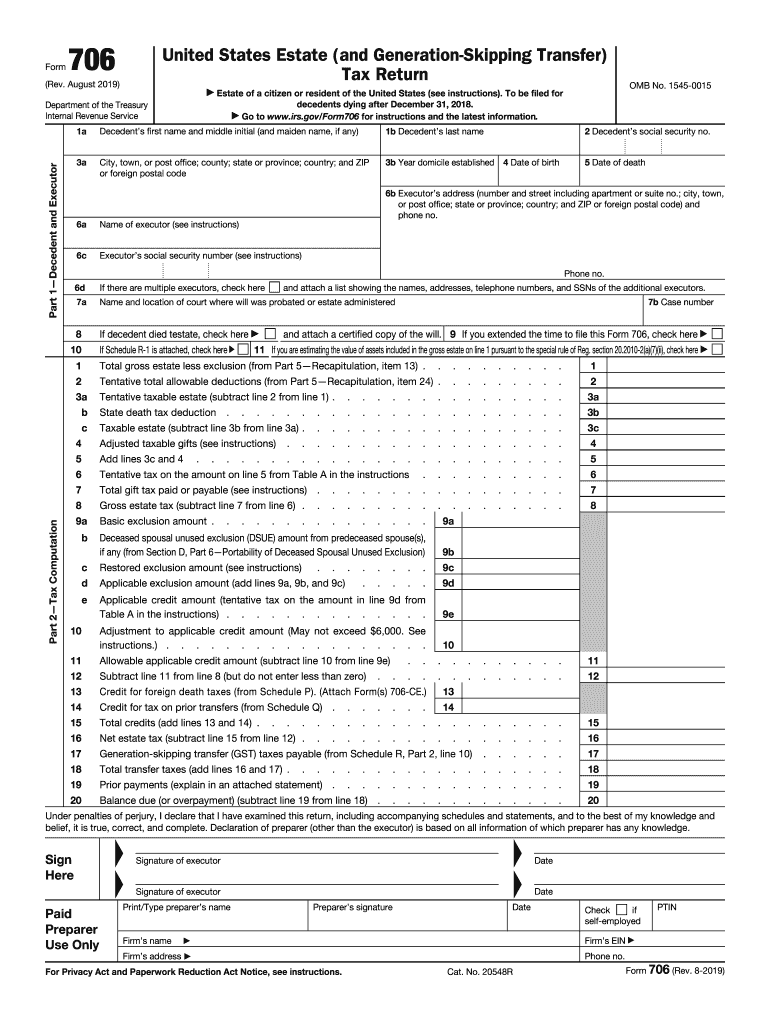

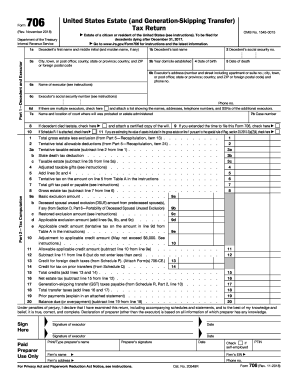

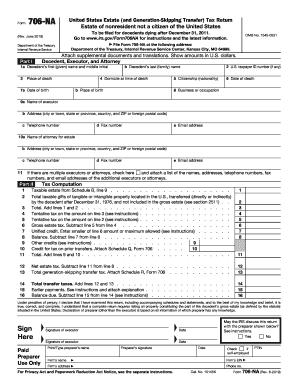

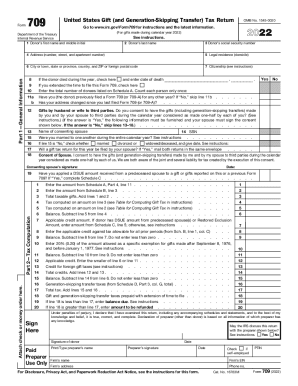

Form 706 is the U.S. Estate Tax Return, used to report the value of a decedent's estate and calculate the federal estate tax. The form is filed with the Internal Revenue Service (IRS) by the executor of the estate.

What is the purpose of form 706?

Form 706 is used to report the estate taxes that are due from an estate of a deceased person. The estate tax is paid by the estate itself, not the beneficiaries. Form 706 is used to report the value of the estate, including the net estate, any deductions, and the tax due. It also provides information to the IRS about the assets and liabilities of the estate.

What is the penalty for the late filing of form 706?

The penalty for late filing of Form 706 is $10 for each month or part of a month that the return is late, up to a maximum of 25% of the amount of the tax due.

Who is required to file form 706?

Form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is required to be filed by the executor or administrator of a decedent's estate. It is filed to report and pay any estate tax owed to the Internal Revenue Service (IRS) when the value of the decedent's estate exceeds the applicable federal estate tax exemption amount.

How to fill out form 706?

Form 706 is a tax form that is used to calculate and report estate taxes for individuals who have passed away. Filling out this form can be complex and it is recommended to seek the assistance of a tax professional or estate planning attorney. However, here are the general steps to fill out Form 706:

1. Gather all necessary information and documents: You will need the deceased person's personal information, such as their full name, Social Security number, and date of birth. Additionally, you will need the details of their assets, including real estate, bank accounts, investments, and life insurance policies.

2. Determine the estate's gross value: Calculate the total value of the assets as of the date of the decedent's death. This includes the fair market value of all assets, including cash, stocks, bonds, real estate, business interests, insurance proceeds, and other assets.

3. Subtract allowable deductions: Calculate any allowable deductions based on the instructions provided on the form. This may include funeral expenses, debts owed by the deceased, and certain administrative expenses.

4. Calculate the net estate value: Subtract the allowable deductions from the gross value to determine the net estate value.

5. Determine the unified credit: Calculate the unified credit available for the estate. This credit allows for a certain amount of the estate's value to be exempt from estate taxes. The unified credit amount may vary each year, so refer to the instructions for the specific year in question.

6. Calculate the estate tax: Calculate the estate tax owed by multiplying the remaining net estate value (after deducting the unified credit) by the applicable tax rate. Again, refer to the instructions for the specific year in question for the tax rate.

7. Complete the remaining sections of the form: Provide information about the decedent's spouse, any other beneficiaries, gifts made during their lifetime, and any previous tax filings or payments made.

8. Sign and submit the form: Sign the completed form and any associated schedules, and submit it to the Internal Revenue Service (IRS) along with any required supporting documents by the deadline. Be sure to keep a copy of the form and supporting documents for your records.

Keep in mind that these steps are a general guide, and it is advised to seek professional assistance to ensure accurate completion of Form 706, as estate tax laws can be complex and subject to change.

What information must be reported on form 706?

Form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is used to report the value of an individual's estate and calculate any estate tax owed. The following information must be reported on Form 706:

1. Personal Information: The decedent's name, Social Security number, date of death, and address.

2. Executor Information: The name, mailing address, and contact information of the executor or personal representative handling the estate.

3. Gross Estate: The total value of the decedent's assets at the time of their death, including real estate, bank accounts, investments, business interests, and personal property. This section requires a detailed list of each asset, its fair market value, and any debts or liabilities associated with it.

4. Deductions: Certain deductions can be claimed to reduce the gross estate, such as funeral expenses, administrative expenses, debts, mortgages, and casualty losses.

5. Taxable Estate: The taxable estate is calculated by subtracting the allowed deductions from the gross estate value. This amount is then used to determine the estate tax liability.

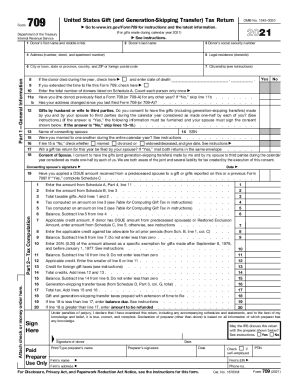

6. Gifts and Prior Transfers: Information regarding any gifts made by the decedent during their lifetime that exceeded the annual gift tax exclusion. This includes gifts made within three years of death and any gift or inheritance tax paid.

7. Generation-Skipping Transfers: Information on any transfers made to skip persons, such as grandchildren or non-relatives, during the decedent's lifetime or at death. Certain exemptions and exclusions may apply.

8. Tax Computation: This section calculates the total estate tax owed based on the taxable estate and applies credits or exemptions available under the tax laws.

9. Payment and Refund: Information on the payment of any estate tax due or requesting a refund if excess tax was paid.

10. Signatures: The return must be signed by the executor or other authorized individuals, with supporting documentation attached.

It is important to note that the information required on Form 706 may vary depending on the specific circumstances of the estate and any applicable tax laws and regulations. It is recommended to consult a qualified estate tax professional or tax attorney for assistance in completing Form 706 accurately.

When is the deadline to file form 706 in 2023?

The deadline to file Form 706 (United States Estate (and Generation-Skipping Transfer) Tax Return) in 2023 is usually nine months after the date of the decedent's death. However, it is always advisable to consult the Internal Revenue Service (IRS) or a tax professional for the most accurate and up-to-date information regarding deadlines and specific requirements.

How can I edit irs form 706 from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including form 706, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I edit form 706 1999 online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your 706 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How can I edit 706 form on a smartphone?

The easiest way to edit documents on a mobile device is using pdfFiller’s mobile-native apps for iOS and Android. You can download those from the Apple Store and Google Play, respectively. You can learn more about the apps here. Install and log in to the application to start editing 706 form.