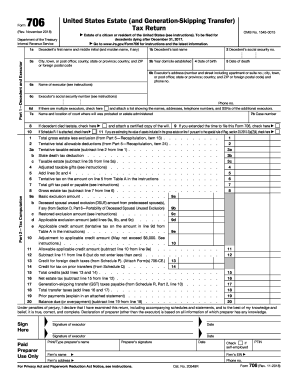

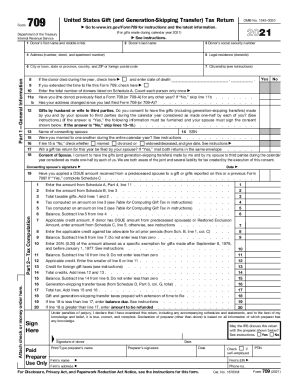

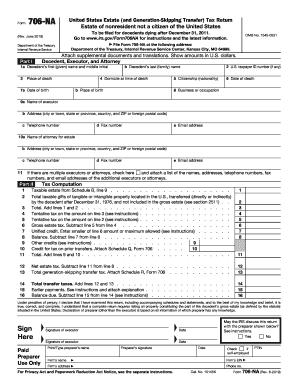

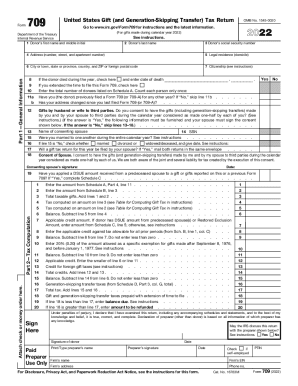

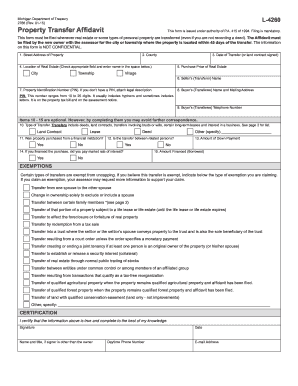

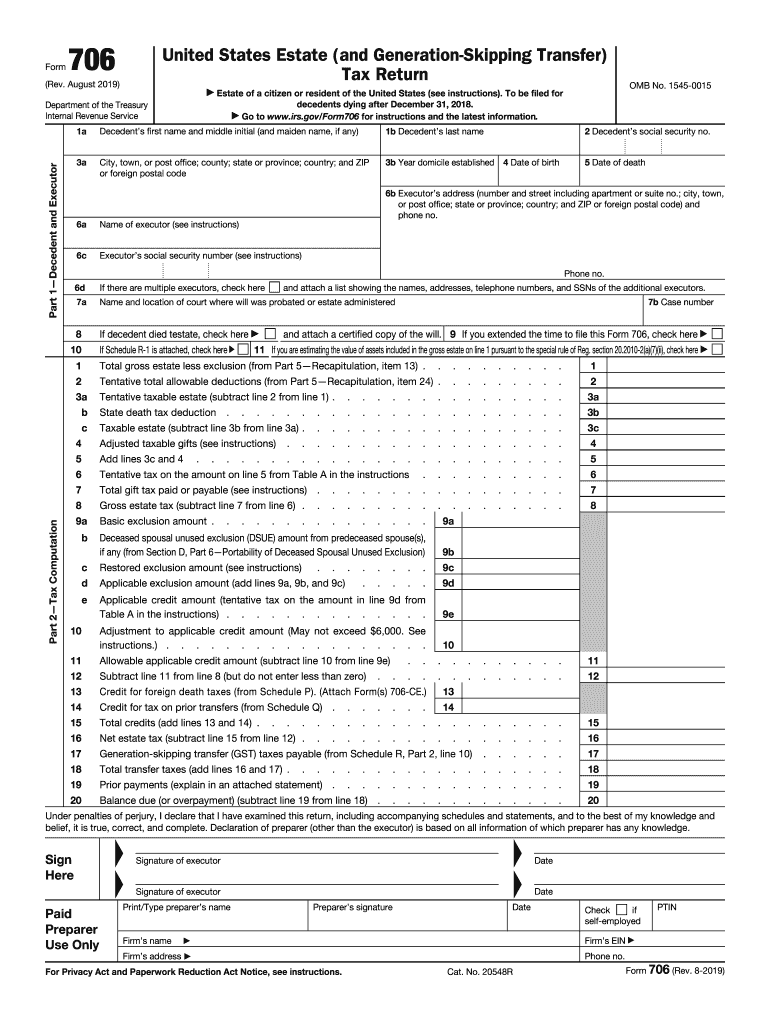

IRS 706 2019-2025 free printable template

Instructions and Help about IRS 706

How to edit IRS 706

How to fill out IRS 706

Latest updates to IRS 706

All You Need to Know About IRS 706

What is IRS 706?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 706

What should I do if I discover an error on my submitted IRS 706?

If you find a mistake on your IRS 706 after submission, you can file an amended return using Form 706-X. This allows you to correct any discrepancies in the original form. It's crucial to submit the amended version as soon as possible to avoid potential implications and ensure accurate recording by the IRS.

How can I verify if my IRS 706 has been processed?

To check the status of your filed IRS 706, you can contact the IRS directly or use the IRS online account system. They can provide updates on whether your form has been received and is in processing, as well as notify you of any issues that might require your attention.

What issues should I be cautious of to avoid errors in my IRS 706 submission?

Common errors in completing IRS 706 include miscalculation of the taxable estate and incorrect valuation of assets. To minimize mistakes, ensure all documents are accurate and review calculations thoroughly. Consulting with a tax professional can also help in navigating complex situations.

Are there specific requirements for e-signatures on IRS 706 filings?

E-signatures are accepted for IRS 706 submissions under certain conditions. The IRS requires the use of specific software that complies with their electronic filing standards, so be sure to check if your e-filing method adheres to those guidelines.

What should I do if I receive a notice from the IRS about my IRS 706?

If you receive a notice regarding your IRS 706, carefully read the correspondence to understand the issue. Gather any required documentation and respond promptly, providing any necessary information or clarification to resolve the matter effectively.

See what our users say