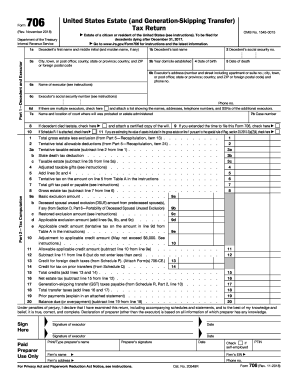

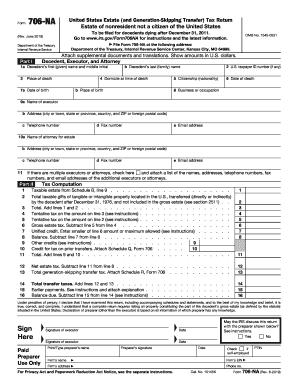

IRS 706 2019-2025 free printable template

Show details

40. Enter here and on Schedule R Part 2 line 9. SCHEDULE R-1 Form 706 Payment Voucher Executor File one copy with Form 706 and send two copies to the fiduciary. 8. Fiduciary Check here if this Schedule PC is being filed with the original Form 706 or is being filed by the same fiduciary who filed the original Form 706 for decedent s estate. Daytime telephone number 7. Number of Claims. Enter number of Schedules PC being filed with Form 706. Each separate claim or expense requires a separate...

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS Form 706

Step-by-Step Instructions for Modifying IRS 706

Guidelines for Completing IRS Form 706

Understanding and Utilizing IRS Form 706

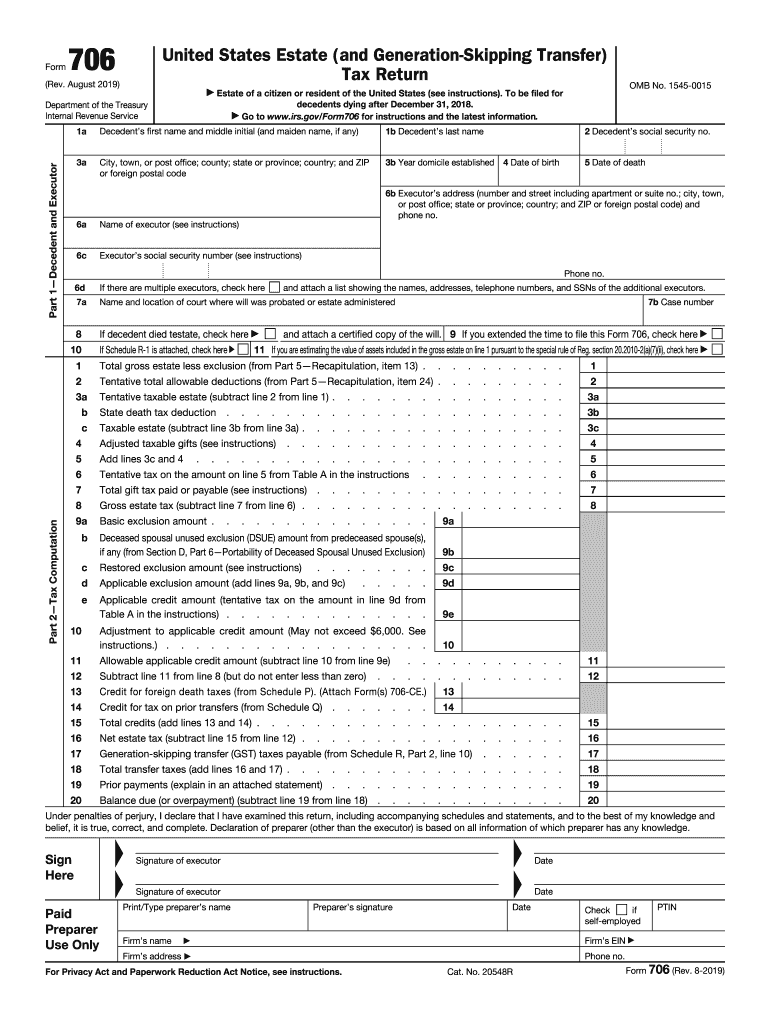

IRS Form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return, is essential for reporting the estate tax imposed on the transfer of property for individuals who pass away. It plays a vital role in estate planning and administration, ensuring compliance with federal tax laws. In this guide, you'll learn how to navigate this complex form with practical, step-by-step instructions, key insights about its purpose, and recent updates relevant to filers.

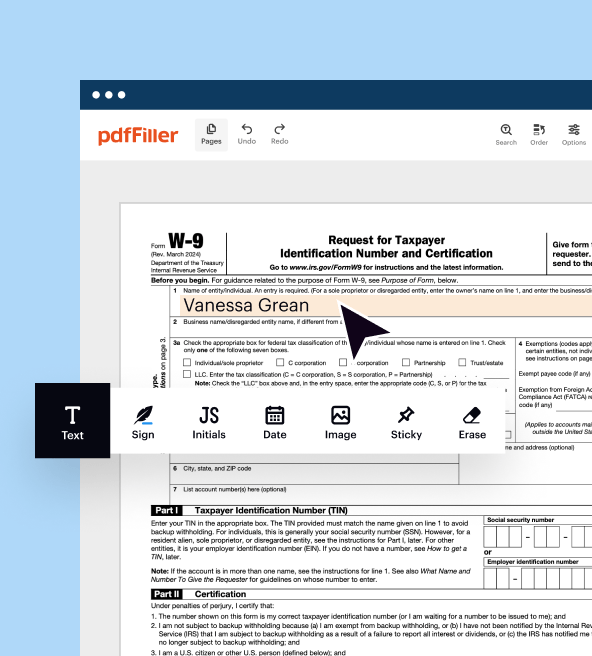

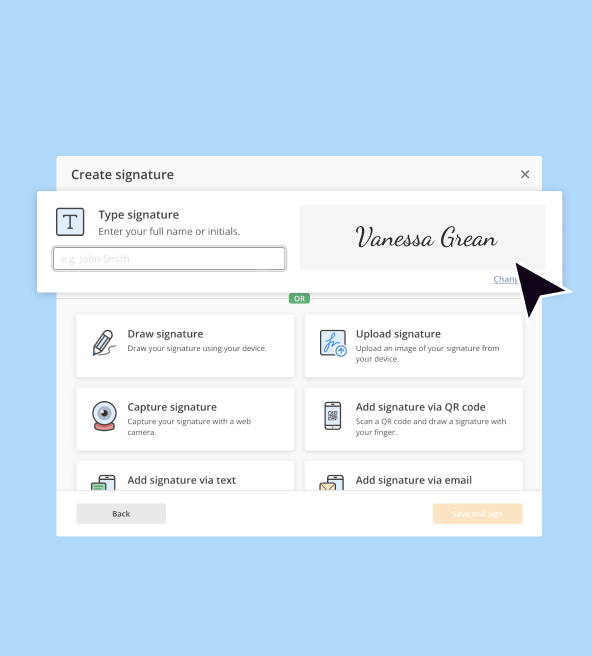

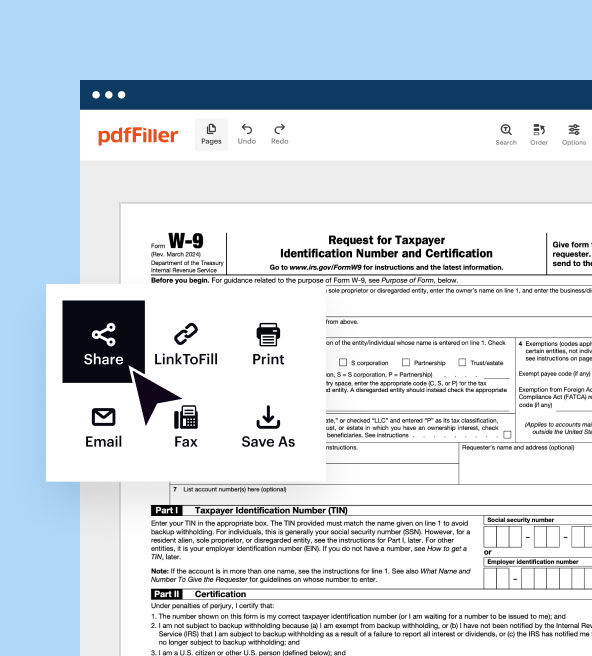

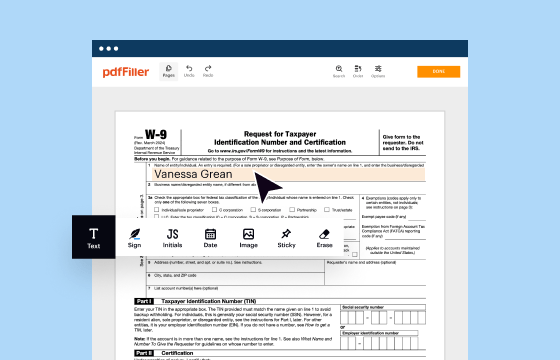

Step-by-Step Instructions for Modifying IRS 706

To effectively edit Form 706, follow these steps:

01

Review the latest version of IRS 706 available on the IRS website.

02

Gather necessary financial documents reflecting the decedent’s assets and liabilities.

03

Consult IRS instructions specific to Form 706 for updates on valuation methods or deadlines.

04

Ensure that all beneficiary information is accurate and complete for transparency.

05

Utilize tax software or professional services if necessary to ensure compliance.

Guidelines for Completing IRS Form 706

Completing Form 706 effectively requires careful attention to detail. Follow these instructions:

01

Enter the decedent’s name and Social Security number at the top of the form.

02

Report the date of death accurately; this is crucial for determining tax liability.

03

Complete the asset section thoroughly, listing all properties, including real estate, stocks, and personal belongings.

04

Include debts, funeral expenses, and administrative costs to arrive at the net taxable estate.

05

Consider using IRS valuation guidelines for real estate and other assets to avoid discrepancies.

Show more

Show less

Recent Developments and Modifications to IRS Form 706

Recent Developments and Modifications to IRS Form 706

Recent updates to IRS Form 706 include changes in exemption thresholds and adjustments in filing instructions that impact estate planning and tax obligations. For the latest fiscal year, the exemption for estate taxes has been increased to $12.92 million per individual. This change can significantly affect estate planning strategies.

Essential Insights into IRS Form 706

Defining IRS Form 706

The Purpose of IRS Form 706

Who Needs to Fill Out IRS Form 706?

Eligibility for Form Exemptions

Human Components of IRS Form 706

IRS Form 706 Filing Deadline

Comparative Analysis of IRS 706 with Related Forms

Transactions Covered by IRS Form 706

Required Number of Copies for Submission

Penalties for Non-Compliance with IRS Form 706 Submission

Information Required for Filing IRS 706

Accompanying Forms for IRS Form 706

Filing Address for IRS Form 706

Essential Insights into IRS Form 706

Defining IRS Form 706

IRS Form 706 is a crucial document for estates that exceed federal tax exemption limits, needing to report the value of the estate and calculate any owed taxes. It encompasses various aspects of estate distribution and settlement under U.S. tax laws.

The Purpose of IRS Form 706

This form serves to determine estate tax liabilities, ensuring compliance with federal regulations governing the transfer of wealth after death. The completed form provides an essential overview of the decedent’s property value and how much tax is owed.

Who Needs to Fill Out IRS Form 706?

Generally, estates with a gross value exceeding the federal exemption limit at the time of the decedent's passing must complete Form 706. This applies regardless of the state tax implications and includes all types of assets.

Eligibility for Form Exemptions

Exemptions for filing Form 706 may include:

01

Gross estate value below $12.92 million for the current tax year.

02

Certain qualified family businesses and farms may qualify for special considerations.

03

Spouses who inherit property can typically defer taxation until their passing.

Human Components of IRS Form 706

Form 706 consists of several sections that include estate values, deductions, and taxes owed:

01

Information on the decedent’s property and debts.

02

Adjustments for expenses, such as funeral costs and administrative fees.

03

Calculations for allowable deductions, including charitable contributions.

IRS Form 706 Filing Deadline

The deadline for submitting IRS Form 706 is typically nine months after the date of death of the individual. It is crucial to adhere to this timeline to avoid penalties and ensure the smooth management of estate assets.

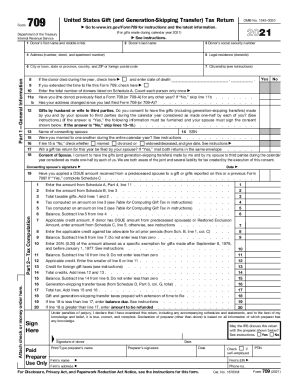

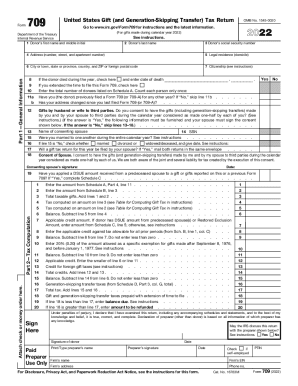

Comparative Analysis of IRS 706 with Related Forms

Compared to other estate-related forms, such as Form 709 (Gift Tax Return), Form 706 addresses cumulative estate values rather than gifts made during the decedent's life. Form 706 encompasses a broader scope, addressing the transfer of wealth upon death, while Form 709 focuses on gifts above a certain annual threshold.

Transactions Covered by IRS Form 706

Form 706 applies to a wide range of transactions, including but not limited to:

01

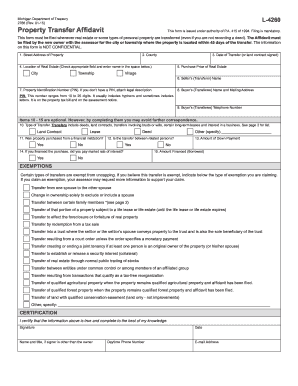

The transfer of real estate properties.

02

Sales of business assets or partnerships.

03

Life insurance payouts included in the gross estate.

Required Number of Copies for Submission

Usually, the IRS requires one completed copy of Form 706 for submission. However, you should retain additional copies for personal records and heirs for reference.

Penalties for Non-Compliance with IRS Form 706 Submission

Failure to file IRS Form 706 can lead to severe penalties. Examples include:

01

A failure-to-file penalty that can amount to 5% of the unpaid tax per month, up to 25%.

02

Interest accrues on unpaid taxes, compounding the total liability.

03

In severe cases, legal ramifications could arise; estate representatives may face personal liability.

Information Required for Filing IRS 706

When preparing to file Form 706, gather the following essential information:

01

Detailed asset valuations, including current market estimates.

02

Documentation of debts and expenses for proper deductions.

03

Estimates of funeral and administrative expenses.

Accompanying Forms for IRS Form 706

Depending on the estate's complexity, additional forms may accompany IRS Form 706, such as:

01

Form 709 for any gifts made during the decedent's lifetime.

02

Form 2848 (Power of Attorney) if a tax professional is assisting with the filing.

Filing Address for IRS Form 706

Submit your completed Form 706 to the appropriate address specified in the IRS instructions based on the estate's location. Review the IRS website for any updates on submission addresses.

Understanding and completing IRS Form 706 is crucial for compliance and effective estate management. With the updated exemptions and clear guidance, you can navigate the complexities of estate tax successfully. If you're uncertain or need assistance, consider consulting a tax professional or utilizing services to ease the filing process.

Show more

Show less

Try Risk Free

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.